Rules For Inherited Ira 2025

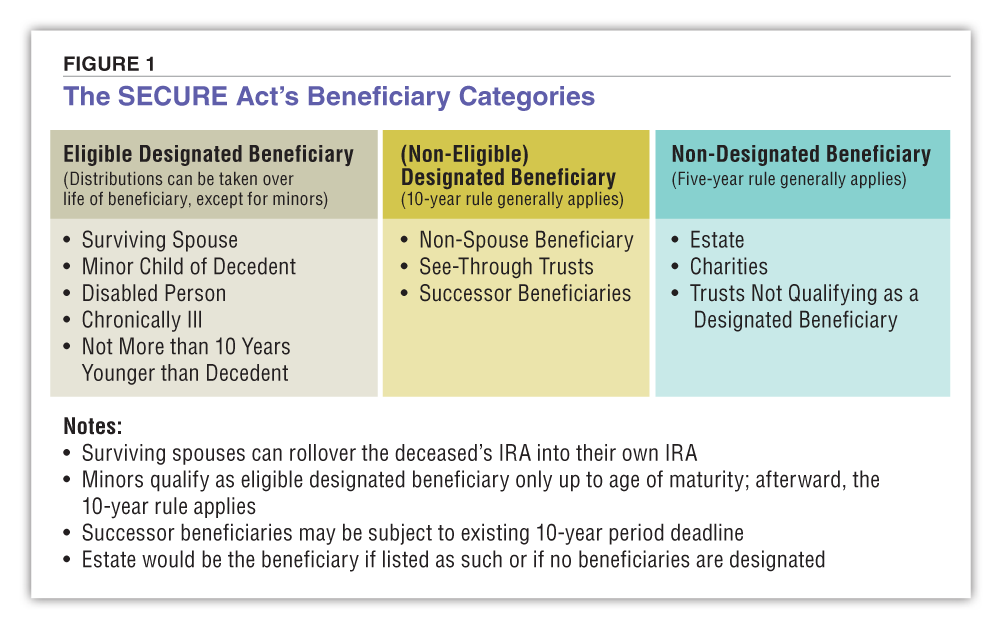

Rules For Inherited Ira 2025. It's important to understand the updated inherited ira distribution rules tied to the recent change in the secure act, including its latest version, secure 2.0. Before 2025, if you inherited an ira and you were a designated beneficiary, you could do what was called a.

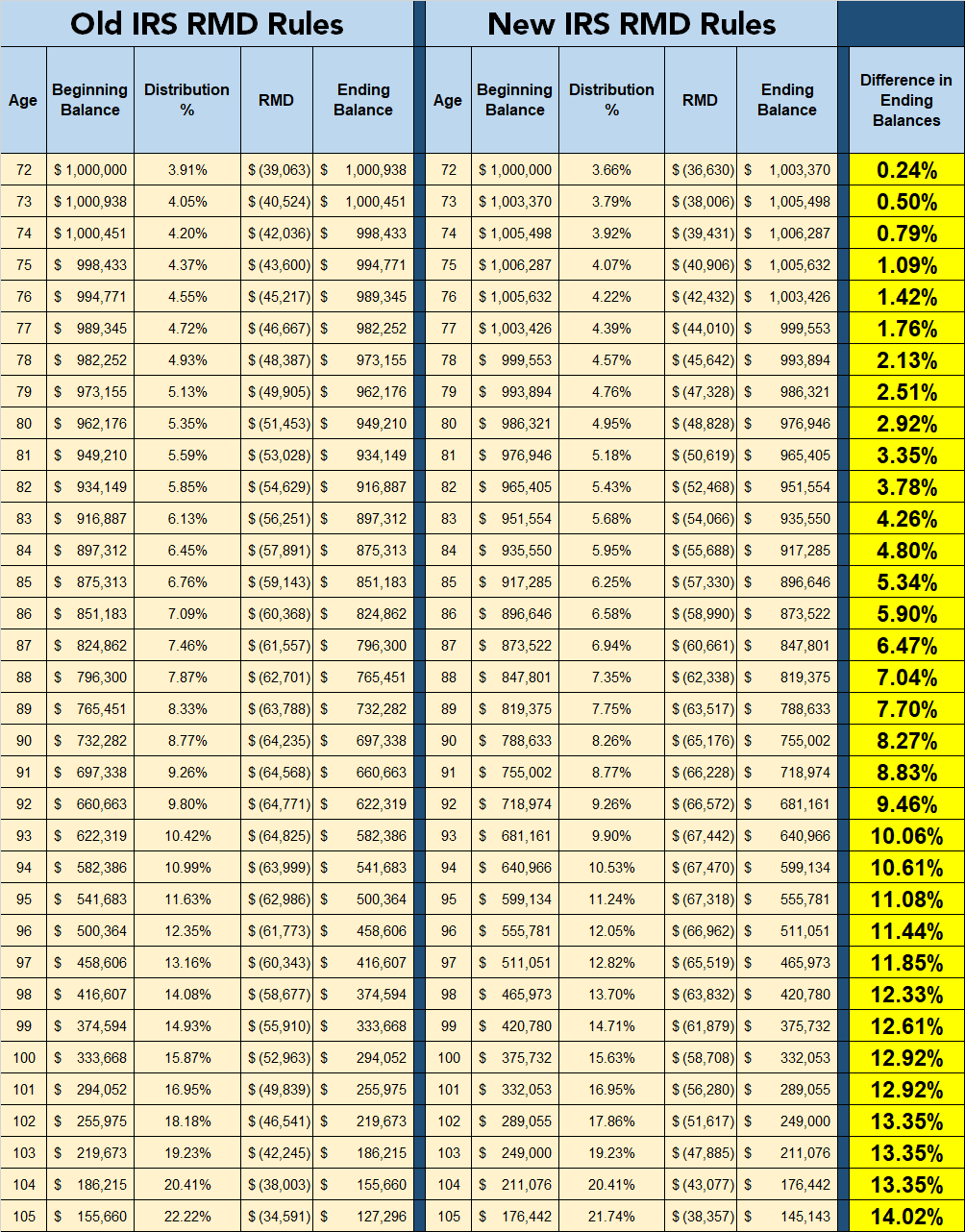

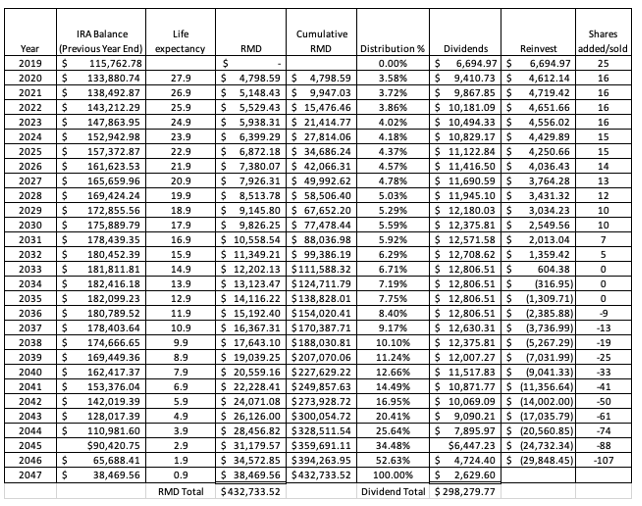

Ed slott, cpa, and bob keebler, cpa/pfs, discuss the complicated inherited ira rmd rules and what is required in 2025 and 2025 in this episode of the pfp section podcast. When you inherit an ira, many of the irs rules for required minimum distributions (rmds) still apply.

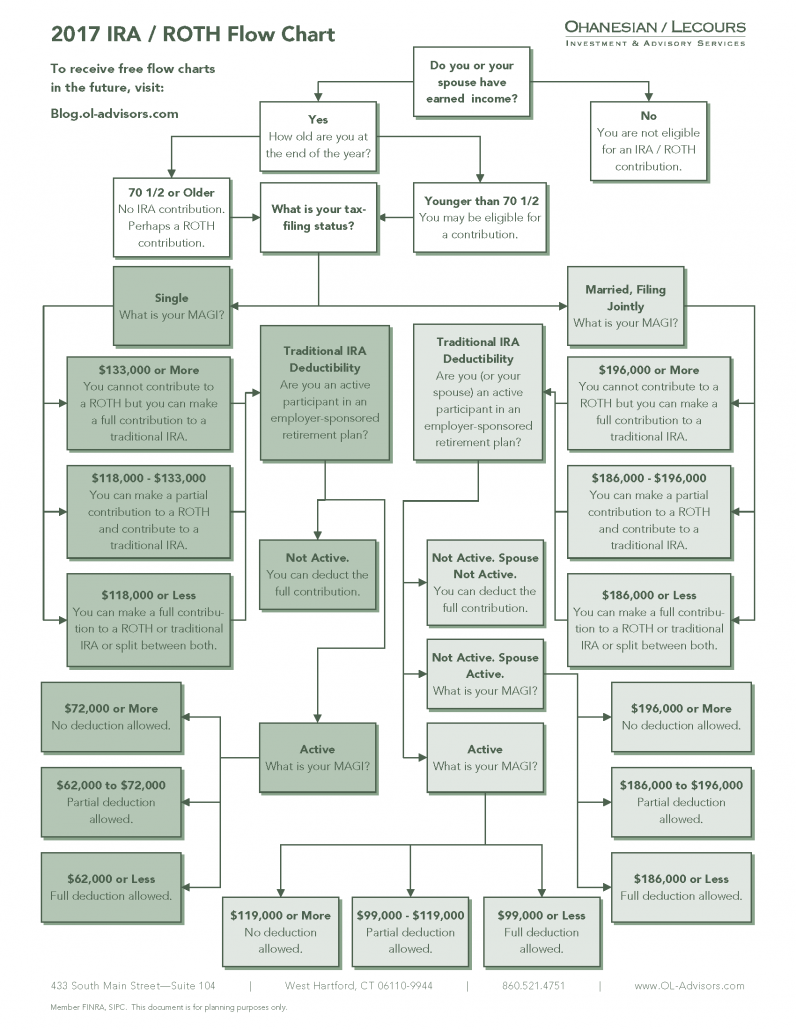

InheritedIRAFlowchart J. H. White Financial, However, there may be additional. Use younger of 1) beneficiary’s age or 2) owner’s age at birthday in year of death.

YearEnd Planning RMD & Inherited IRA Strategies Relative Value Partners, Best roth ira for beginner investors. Before 2025, if you inherited an ira and you were a designated beneficiary, you could do what was called a.

What are the New Rules for Inherited IRAs? Inflation Protection, Slideshow march 11, 2025 at 11:06 am share & print. The rules guiding the inheritance of an individual retirement account (ira) when the ira owner dies are complicated, but at least one aspect is straightforward:.

You’ve inherited an IRA. What happens next? CD Wealth Management, Required minimum distributions (rmds) the irs mandates that beneficiaries begin taking distributions from an inherited ira within a certain timeframe. Use younger of 1) beneficiary’s age or 2) owner’s age at birthday in year of death.

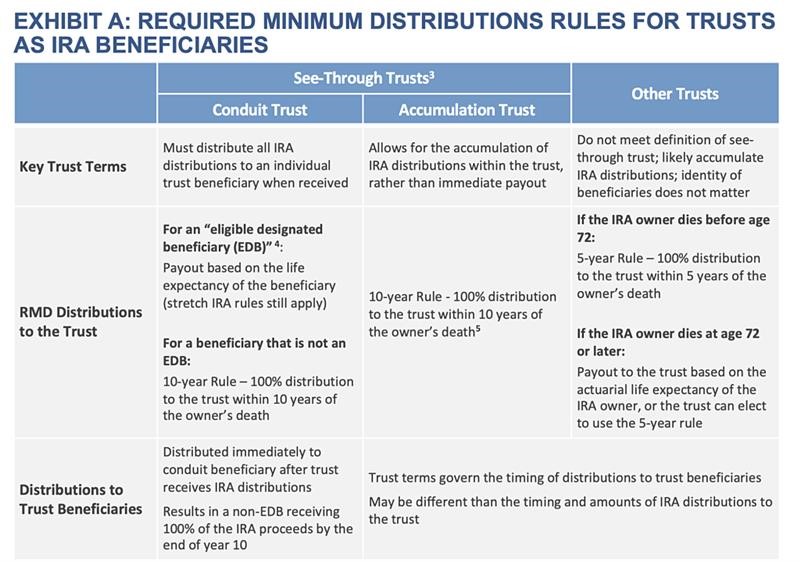

Rmd Tables For Inherited Ira Elcho Table, It's important to understand the updated inherited ira distribution rules tied to the recent change in the secure act, including its latest version, secure 2.0. When you inherit an ira, many of the irs rules for required minimum distributions (rmds) still apply.

Inherited Ira Rmd Table Non Spouse Matttroy, It's important to understand the updated inherited ira distribution rules tied to the recent change in the secure act, including its latest version, secure 2.0. Spousal transfer (treat as your own) option #2:

Inherited IRA Rules Before and After the SECURE Act AAII, Use younger of 1) beneficiary’s age or 2) owner’s age at birthday in year of death. Irs delays final ruling on changes to inherited ira required distributions until 2025, and extends the rmd penalty waiver to 2025 for certain beneficiaries.

Inherited IRA Rules YouTube, Before 2025, if you inherited an ira and you were a designated beneficiary, you could do what was called a. Withdrawing from an inherited ira.

Visualizing IRA Rules Using Flowcharts, It's important to understand the updated inherited ira distribution rules tied to the recent change in the secure act, including its latest version, secure 2.0. Most industry professionals believed that the 10.

Required Minimum Distribution Table For Inherited Ira Elcho Table, It also tacked on many other potentially confusing new rules for inherited accounts, but delayed penalties for the failure to take rmds for tax years 2025 through. One way wealth passes from generation to generation is through inherited iras.

Irs delays final ruling on changes to inherited ira required distributions until 2025, and extends the rmd penalty waiver to 2025 for certain beneficiaries.