Maximum Oasdi Withholding 2025

Maximum Oasdi Withholding 2025. For earnings in 2025, this base is $168,600. This is also called the taxable maximum, meaning that any income above this limit is not subject to oasdi taxes.

What is the oasdi limit 2025? Of course, both employers and employees pay the 6.2% social security tax rate,.

The maximum withholding wage base has increased from $160,200 to $168,600 to coincide with the 2025 federal oasdi wage base.

Oasdi Max 2025 Catie Bethena, The maximum withholding on fica ee oasdi for 2025 is $10,453.20. This is up from $9,932.40.

Max Medicare Tax Withholding 2025 Aurea Caressa, This amount is also commonly referred to as the taxable maximum. You will pay federal income.

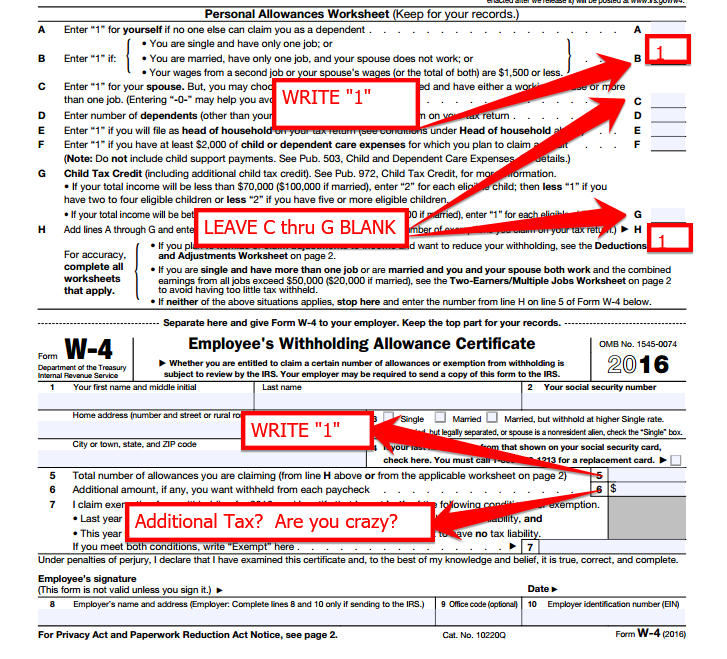

W4 2025 Form Printable California Elga Nickie, As of 2025, the maximum amount of income taxed for social security topped out at $168,600. Oasdi contribution limits for 2025.

Oasdi Max 2025 Betsy Lucienne, The first $168,600 of your wages is. In 2025, the income limit for oasdi tax is $168,600.

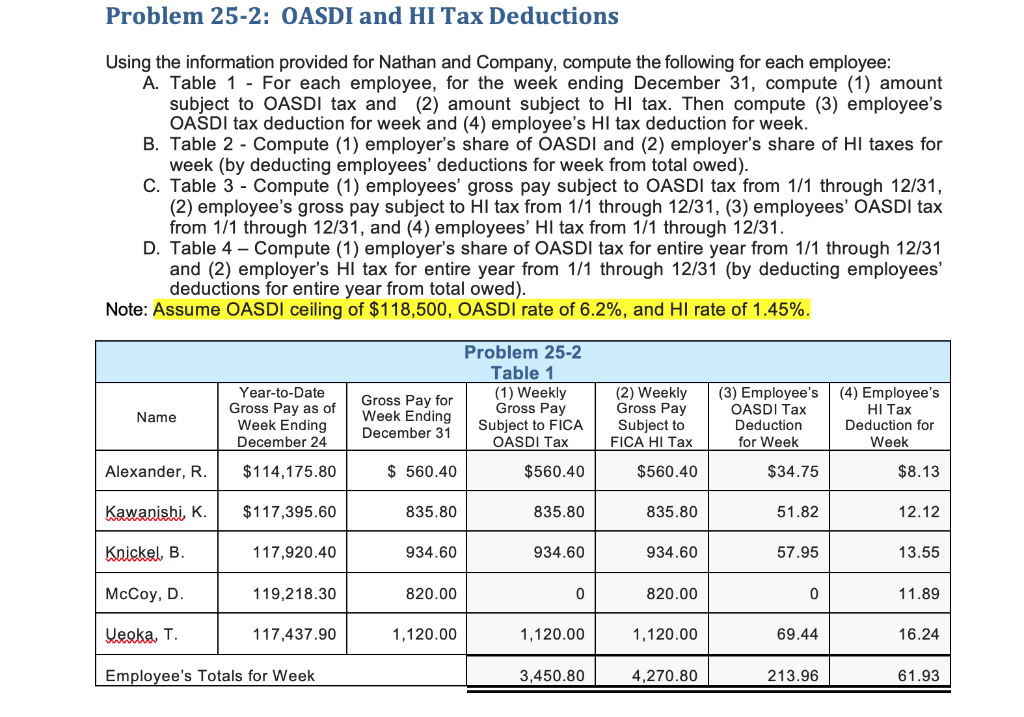

Solved Problem 252 OASDI and HI Tax Deductions Using the, The oasdi limit in 2025 is $168,600. The social security limit is $168,600 for 2025, meaning any income you.

Social Security Withholding 2025 W4 Form Myrle Laverna, For 2025, the maximum earnings base (i.e., the maximum amount of annual earnings subject to the tax) for the oasdi tax is $168,600. Of course, both employers and employees pay the 6.2% social security tax rate,.

Oasdi Limit 2025 Estimated Bianca Jennifer, This amount is also commonly referred to as the taxable maximum. The first $168,600 of your wages is.

Social Security Tax Limit 2025 Withholding Table Adora Ardelia, This is up from $9,932.40. So, the most oasdi tax that you will need to pay.

Single Withholding Rate 2025 Adria Ardelle, The maximum social security employer contribution will. The oasdi limit, which affects your paycheck by deducting a portion of it for social security taxes, is an impactful part of the.

OASDI withholding Archives Air Force Magazine, Social security tax limit 2025 withholding. The oasdi limit, which affects your paycheck by deducting a portion of it for social security taxes, is an impactful part of the.